Financial Management

NGRERP offers fully-integrated ERP accounting software tools to manage all aspects of an organization’s financial management and compliance requirements. NGRERP provides a complete set of ERP accounting software functionality that is both comprehensive and scalable to manage a variety of businesses that range from small businesses to large, multinational corporations with multiple legal entities and divisions.

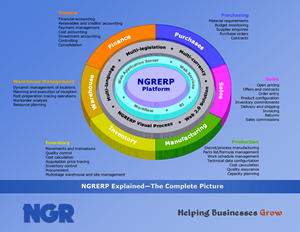

In addition to standard general ledger, accounts payable, and accounts receivable functionality, NGRERP includes a robust financial report writer. Most importantly, NGRERP's ERP accounting software functionality is fully-integrated with the entire NGRERP application, including inventory management, warehouse management, purchasing, order processing, manufacturing and planning, CRM, business intelligence, and e-Commerce, eliminating the need for duplicate data entry in multiple software packages and streamlining the organization’s financial management and accounting operations.

General Ledger

The NGRERP general ledger offers a flexible chart of accounts combined with a series of source journals that support multi-level account definition and consolidation with real-time access to overall cash flow and profitability. In addition, the general ledger supports flexible period definition, automated period end processing, and is completely multicurrency-enabled. NGRERP's general ledger supports manual, recurring, and reversing journal entries, and allocations.

Accounts Receivable

NGRERP's accounts receivable functionality strengthens the order-to-cash process flow by providing a controlled yet streamlined approach to billing and payment processing. This fully-integrated solution offers the utmost in flexibility and efficiency for NGRERP software users.

The accounts receivable processing is fully integrated with rest of the NGRERP software solution, allowing an organization to share information with customer service and sales personnel. In addition to strong multicurrency and customer pricing capabilities, NGRERP includes a credit and collections process to enhance overall customer service and cash flow.

Accounts Payable

NGRERP's accounts payable functionality provides an online voucher system that applies a controlled set of processes in a flexible yet effective manner. This automated process manages purchases and payables in a timely fashion and facilitates efficient operations, reduces data errors, enhances financial visibility, and improves cash flow.

The accounts payable solution supports a multi-level company structure, multicurrency transactions, multiple bank accounts, corporate cash accounting practices, and electronic funds processing. These transactions feed the general ledger via the accounts payable source journal. Accounts payable data is available for flexible reporting through NGRERP's workbenches and dashboards.

Cost Accounting

NGRERP software provides strong cost accounting and financial management by tightly monitoring and tracking all cost elements of a given product whether manufactured or purchased. NGRERP's cost accounting generates accurate costing and performance information, providing improved visibility to the organization’s financial opportunities to reduce excessive cost elements and increase profitability.

Multi-Currency

NGRERP's integrated financial management software manages multinational operations and multicurrency transactions with exchange rate updates and currency conversions. NGRERP provides a variety of exchange rate options to support efficient processing while complying with GAAP. In addition, NGRERP automatically determines unrealized gain or loss due to currency rate fluctuations and restates financial information at the new exchange rate.

Bank Management

NGRERP's financial management provides strong support for bank management that extends across the general ledger, accounts payable, and accounts receivable functions. NGRERP allows the entry of multiple bank accounts each of which can have a unique base currency to support organizations ranging from a single business entity to multiple legal entities across one or more countries. Bank reconciliation can be performed manually or in an automated manner utilizing an electronic feed from the customer’s given financial institution.

Tax Management

NGRERP offers sales tax management to help control tax-related transactions and mitigate risk. NGRERP supports sales tax calculations at multiple levels and locations while also supporting the necessary variations to accommodate business activities in multiple countries. NGRERP also integrates with external tax packages to provide the optimum solution for management and reporting of tax liability and expense.

Budget Management

NGRERP improves organizational accountability by strengthening the accuracy of the corporation's budget activity and by providing online visibility to actual performance against projected budgets. This improvement in budget management is accomplished by utilizing NGRERP's historical data to create concise, accurate budgets for management review and adjustments where needed. NGRERP generates multi-level budgets for standard sales cycles and seasonal patterns, and supports the entry of manually created budgets. This fully-integrated approach provides a centralized view of multiple-entity budgets, significantly reduces data integrity issues, and improves overall budget accuracy.

Corporate Cash Management

As part of NGRERP's financial management solution, corporations can elect to manage and perform accounts payable and accounts receivable at a corporate level via the corporate cash management functionality. In doing so, the associated accounts payable or accounts receivable transactions roll up to the higher-level business entity, where the actual payment or posting of cash processes take place respectively. NGRERP also reflects the completion of processing for the detailed transactions at the lower-level business entity and manages the associated intercompany financial transactions in accordance with GAAP standards. Corporate cash processing can be a critical element for executing timely payments and optimizing a corporation’s overall cash management position.

Compliance

NGRERP financial management software supports organizations in their compliance efforts through multi-level security with segregation of duties by user, integrated workflow management, and complete master file and transaction audit trails. NGRERP integrates multiple entity companies into a single system and database image, thus providing one central repository of master files, transactions, and their associated audit trails.